Types of mortgages in the Netherlands

The best mortgage for an expat depend on lifestyle and personal circumstances. With some Dutch mortgages, you have to start paying off the loan immediately along with the interest, whereas other mortgage types allow you to postpone repayments and only pay the interest instead.

Since the changes in 2013, the only kinds of mortgages that are eligible for the interest tax deduction (renteaftrek) are annuities and linear mortgage models, whereby the loan is repaid within 30 years via monthly repayments.

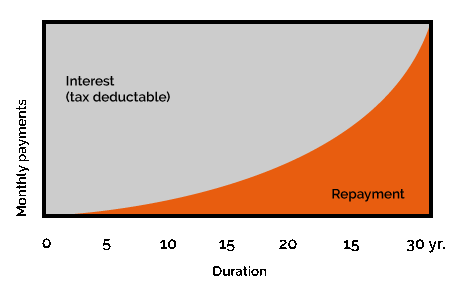

Annuities mortgage (Annuïteiten hypotheek)

In the early years of an annuities mortgage, your monthly payments are largely made up of interest and a small part loan repayment. Over time, as you gradually decrease your debt, the amount of interest you pay also decreases. Towards the end of the mortgage period, the balance reverses meaning you pay lower interest payments and higher loan repayments. In the early years of the mortgage period, the annuities mortgage usually has lower monthly payments than a linear mortgage.

- Mortgage fully repaid at the end of the duration.

- Monthly amount consists of interest and repayment.

- Fixed gross mortgage payment amount during a fixed-interest period.

- Rising net monthly costs due to decreasing mortgage interest benefit during the term.

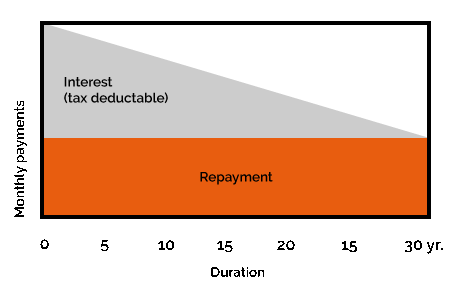

Linear mortgage (Lineaire hypotheek)

With a linear mortgage you repay a fixed amount every month, plus the interest. Your debt is reduced every month, which also reduces the interest. A linear mortgage is useful when you want to pay off your mortgage as quickly as possible, although initial repayments are relatively high.

- Mortgage fully repaid at the end of the duration.

- Fixed repayment during the duration.

- Decreasing monthly payments (gross as net) during the fixed-rate period

- Decreasing monthly payments (gross as net) during the fixed-rate period

What is your maximum mortgage in The Netherlands?

Advice for your personal situation!

Do you want personal advice?

The Home Financials advisor will be happy to answer all your questions and advise you on a mortgage that suits you.