Mortgage Types in the Netherlands

As an expat in the Netherlands, selecting the right mortgage hinges on your lifestyle and circumstances. Some Dutch mortgages mandate immediate repayment of both principal and interest, while others allow you to defer principal payments and pay only interest at first.

Since the 2013 reforms, only annuity and linear mortgages qualify for mortgage interest tax deductions (renteaftrek). Both options require repayment within 30 years through regular monthly payments.

Annuities mortgage (Annuïteiten hypotheek)

What is an Annuity Mortgage?

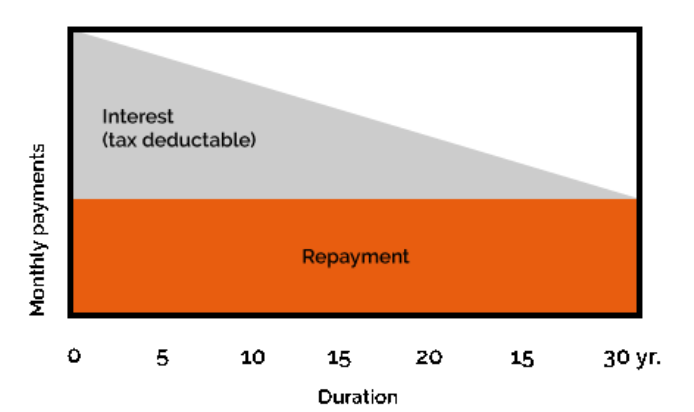

An annuity mortgage features a repayment structure where you make fixed monthly payments, ensuring your mortgage is fully paid off by the end of the term. Initially, your payments consist mainly of interest, with a smaller portion going toward the principal. Over time, this shifts, and your payments will include a larger principal component while the interest portion decreases.

- Fixed Monthly Payments: Consistent payments that start with more interest and gradually reduce the principal.

- Tax Deduction: Eligible for a tax deduction on interest for up to 30 years if used for buying or improving your home.

- Full Repayment: Fully paid off by the end of the term, ensuring no remaining debt.

Linear mortgage (Lineaire hypotheek)

What is an Lineair Mortgage?

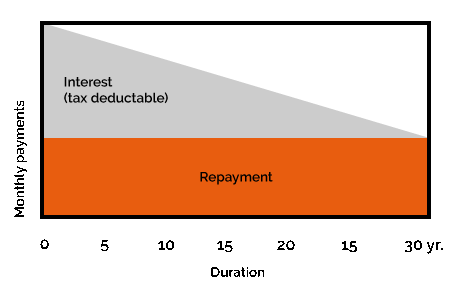

The linear mortgage is a straightforward option that allows you to pay a fixed amount each month, ensuring your loan is fully repaid by the end of the term. Want to find out how much you can borrow? Calculate now or read on to learn more.

- Decreasing Payments, Monthly payments reduce your debt quickly, increasing financial flexibility for future expenses.

- Tax Benefit Enjoy mortgage interest tax deductions for up to 30 years when used for buying, renovating, or improving your home.

- Complete Repayment Your loan is fully paid off by the end of the term, ensuring no remaining debt.

What is an Interest-Only Mortgage?

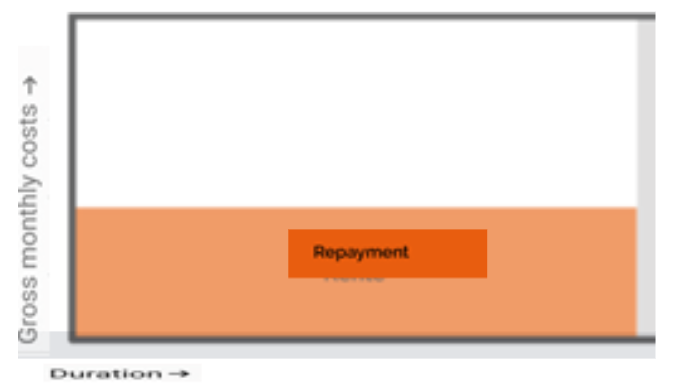

With an interest-only mortgage, you pay only mortgage interest each month; you don’t make any repayments. At the end of the term, you must repay the mortgage in full. If you take out an interest-only mortgage now, you can borrow up to a maximum of 50% of your property’s market value.

- You only pay only interest

- You repay the loan once the mortgage has reached maturity

- Your gross monthly expense stays the same as time passes for as long as the interest rate is fixed

Choosing the right mortgage repayment option depends on your unique financial situation and goals. Each option comes with its own advantages, making it essential to find one that aligns with your budget. At Home Financials, we’re dedicated to helping you discover the perfect solution for your needs.

Let’s take the first step toward your homeownership journey together!

What is your maximum mortgage in The Netherlands?

Advice for your personal situation!

Do you want personal advice?

The Home Financials advisor will be happy to answer all your questions and advise you on a mortgage that suits you.

Reviews

UITSTEKENDTrustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Ik ben zeer tevreden van de werkzaamheden die Sema voor mij heeft verricht. Snelle terugkoppeling. Pittige financiële adviseur. Het is ons gelukt….Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Great person to deal with in any way! Highly recommended!Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. We hebben het getroffen met de inzet van Home Financials. Sema is professioneel, geduldig en goed bereikbaar. Voor ons was het een eerste koophuis dus we gingen er vrij blanco in. Sema nam ons goed mee door alle stappen die je door moet als je een huis koopt. Onze situatie was een stuk gecompliceerder doordat we beide voor een werkgever werken en tegelijkertijd freelance werkzaamheden hebben. Ook daar hebben we geen problemen in ondervonden. Het was gewoon meer werk. Na precies 4 maanden, van eerste afspraak tot daadwerkelijk tekenen hypotheek, was onze zoektocht met succes voltooid. En dat in deze overspannen huizenmarkt.. Al met al erg blij. Nogmaals hartelijk dank Sema voor je soepele handelen! NB: zie 'vergelijkingskaart' voor de tarieven. Glimlach, Ewa, Duy en LennyTrustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Sema is een adviseur met passie voor het helpen van mensen. Ze heeft ons geweldig geholpen door alle stappen en hebben in een korte periode al onze eerste woning kunnen kopen. Ze is eerlijk, zegt waar het op staat en is vanaf het begin duidelijk geweest over de mogelijkheden. Ik zou haar aan iedereen aanraden die een hypotheek adviseur van een hoog niveau zoekt. Bedankt Sema!Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Heel goed geholpen door Sema. Ze pakt goed aan en regelt dingen snel. Zeer behulpzame adviseur.Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Many thanks to you Sema for your great service during all the steps of our mortgage application from starting till the end. Your deep experience, professional approach and very fast responsive attitude lead us to a successful mortgage approval in a record short time. You're the best Home Financials ! It was great to work with you !Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Altijd duidelijk en beschikbaar voor vragen, zowel in persoon als telefonisch. Dankzij haar heb ik nu de perfecte hypotheek. Zeer aanbevolen!Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. Sema was incredibly helpful throughout our home-buying process. Thanks to her, we received rapid mortgage approval from the bank within just four days. She simplified the complex documentation with clear and concise explanations, making the process much easier for us. She managed everything on our behalf and was always just a phone call away, answering all our questions sincerely. We are deeply grateful for her dedication and hard work in helping us purchase our beautiful home. We highly recommend reaching out to Sema and entrusting her with the entire process. We definitely suggest you do the same! 😊 E&CTrustindex verifieert dat de oorspronkelijke bron van de recensie Google is. I am so very much impressed with the services.they are super fast,impressive and reliable.i am very happy. Thanks to sema.Trustindex verifieert dat de oorspronkelijke bron van de recensie Google is. The best mortgage advisor! We are satisfied😁