Mortgage Types in the Netherlands

As an expat in the Netherlands, selecting the right mortgage hinges on your lifestyle and circumstances. Some Dutch mortgages mandate immediate repayment of both principal and interest, while others allow you to defer principal payments and pay only interest at first.

Since the 2013 reforms, only annuity and linear mortgages qualify for mortgage interest tax deductions (renteaftrek). Both options require repayment within 30 years through regular monthly payments.

Annuities mortgage (Annuïteiten hypotheek)

What is an Annuity Mortgage?

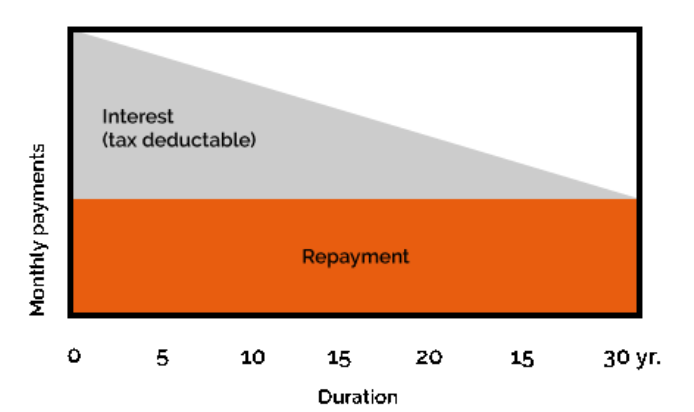

An annuity mortgage features a repayment structure where you make fixed monthly payments, ensuring your mortgage is fully paid off by the end of the term. Initially, your payments consist mainly of interest, with a smaller portion going toward the principal. Over time, this shifts, and your payments will include a larger principal component while the interest portion decreases.

- Fixed Monthly Payments: Consistent payments that start with more interest and gradually reduce the principal.

- Tax Deduction: Eligible for a tax deduction on interest for up to 30 years if used for buying or improving your home.

- Full Repayment: Fully paid off by the end of the term, ensuring no remaining debt.

Linear mortgage (Lineaire hypotheek)

What is an Lineair Mortgage?

The linear mortgage is a straightforward option that allows you to pay a fixed amount each month, ensuring your loan is fully repaid by the end of the term. Want to find out how much you can borrow? Calculate now or read on to learn more.

- Decreasing Payments, Monthly payments reduce your debt quickly, increasing financial flexibility for future expenses.

- Tax Benefit Enjoy mortgage interest tax deductions for up to 30 years when used for buying, renovating, or improving your home.

- Complete Repayment Your loan is fully paid off by the end of the term, ensuring no remaining debt.

What is an Interest-Only Mortgage?

With an interest-only mortgage, you pay only mortgage interest each month; you don’t make any repayments. At the end of the term, you must repay the mortgage in full. If you take out an interest-only mortgage now, you can borrow up to a maximum of 50% of your property’s market value.

- You only pay only interest

- You repay the loan once the mortgage has reached maturity

- Your gross monthly expense stays the same as time passes for as long as the interest rate is fixed

Choosing the right mortgage repayment option depends on your unique financial situation and goals. Each option comes with its own advantages, making it essential to find one that aligns with your budget. At Home Financials, we’re dedicated to helping you discover the perfect solution for your needs.

Let’s take the first step toward your homeownership journey together!

What is your maximum mortgage in The Netherlands?

Advice for your personal situation!

Do you want personal advice?

The Home Financials advisor will be happy to answer all your questions and advise you on a mortgage that suits you.